Make sure you read our most recent reports on Seaport Entertainment (SEG) and Watches of Switzerland (WOSG.L).

We will be publishing a significant (paid) follow-up article on Seaport in January.

This is our first monthly update, so please send feedback in the comments below or to chris.waller@pluralinvesting.com.

We have reached over 1,400 free subscribers and a signficant number of paid subscribers in the two weeks since we formally launched this newsletter. Thank you for subscribing, and upgrade to paid to receive our best content. An annual membership is just $299 and prices are rising on Jan 1. All subscribers before Jan 1 will be protected against price rises forever.

Jet2 (JET2.L)

Jet2 is the UK’s leading package holiday business. The company has the best management team in the industry, market share of 22% and increasing, a long runway for double-digit growth, and substantial net cash. It reported yet another strong set of results a couple weeks ago. What do you have to pay for this all this?

7.5x P/E.

At its results on November 21, Jet2 stated that:

Revenue grew +15% y/y, EBIT +14%, and PBT ex FX +16%.

The company is on track to deliver profits for the full year ahead of market expectations.

Winter '24/25 seat capacity +14% and Summer '25 seat capacity +9%. Bear in mind revenue growth will be higher due to higher prices and a mix shift towards package holidays from flight-only customers.

Commentary on pricing was marginally more positive.

Bournemouth and Luton airport launches next year will bring 700,000 additional seats for Summer '25 and increase the total number of bases to 13. In comparison, the Liverpool launch this year saw 215,000 passengers depart.

Surprisingly, "recent improvements in the macro‐economic environment including falling inflation should help ease some cost base pressures".

This is all set against generally favorable reporting for travel in the UK:

Travel agents are reporting strong sales.

easyJet Holidays continues to see strong demand, with next summer already 30% sold and pricing positive.

On The Beach says that bookings for Summer '25 are "very encouraging".

Most importantly, Jet2’s biggest competitor TUI reported a positive update for pricing and volumes in the UK. But positive for TUI is a +5% increase in bookings for Summer ‘25. Given Jet2’s growth of +9%, we can expect Jet2 to gain share again next year.

I’ve been a shareholder in Jet2 for 12 years now and in that time the stock has gone from £0.7 to £15, but I think this is one of the most compelling times to own the stock.

The company has a market cap of £3bn now, but most investors still think of it as an airline. If you have one takeaway from this article, it should be this:

Jet2 is NOT an airline.

In our view, this is crucial to understanding why Jet2 continues to succeed.

The company sells package holidays for an average of £900, taking customers from the UK to primarily sunny locations in Europe. Although Jet2 owns aircraft, the customer is paying for their entire holiday and the 2 hour flight is only a small component of that. Jet2 does sell leftover seats to flight-only customers, but this is a small portion of profits.

The economics of package holidays are very different to airlines.

The most successful airline in Europe over the last couple decades is arguably Ryanair. Ryanair is famous for low costs, and poor customer service. The reality for 2 hour flights is that although customers complain about poor service, they tend to return anyway if costs are low. This is why Ryanair’s culture and focus on low costs works even though its service is poor.

Things are very different with holidays, where the priorities are almost reversed. If a company messes up your entire holiday, you are never coming back.

Jet2's secret sauce is that it has the best customer service in the industry, which you can verify by talking to people in the industry, looking at consumer surveys, and customer reviews.

We have found that investors dismiss this because it is qualitative. But it is the key reason why Jet2's market share has increased from 2% to 22% over the last decade and the stock has gone from £0.7 to £15.

Here is how better customer service improves Jet2's economics in our view.

Nearly 60% of Jet2's customers book another holiday within 2 years. That is remarkably high given Jet2 only flies to European destinations and not everyone takes a holiday every year. That customer retention number is only 40% at TUI, Jet'2 biggest competitor.

This is a huge gap which explains why Jet2 has been gaining ~2ppts of market share each year.

The most extreme example of this was during Covid. Whereas most travel companies treated customers (and suppliers) poorly, Jet2 refunded most customers quickly and in full. According to the UK government's payment practice reports, in the six months to September 2020 Jet2 paid 76% of invoices within agreed terms vs 36% for TUI.

The result is that Jet2's market share increased by half from 14% to 21% during Covid.

And because of this increased market share, Jet2 is likely to earn £2/shr of net income this year. It earned £0.9/shr pre-Covid.

It will be interesting to see whether a new competitor like easyJet Holidays will be able to shake off its culture of low costs and focus on excellent customer service.

The early signs are it will not.

In the well-regarded Which? annual survey of package holiday customers, Jet2 has finished #1 over the last two years with an 84% satisfaction rate. easyJet holidays saw its ranking decline from #18 to #20.

TUI saw its ranking decline from #17 to #19, and the company is now offering flights from Ryanair.

Macfarlane (MACF.L)

Macfarlane trades for 9x FCF, generates a 25% post-tax ROTC, has sustainable competitive advantages, almost no debt, and is run by an honest and competent management team. The opportunity exists because it is a boring small cap in the specialty packaging industry listed in the UK, trades £300k/day, and receives limited promotion from management or the sell-side.

The stock is down 15% from when we wrote it up in July and down 25% from its peak in March, but we think the thesis is playing out and the opportunity is more attractive.

Throughout this year, the big concern with Macfarlane has been that it’s EBIT margins - which increased from 5.9% in 2019 to 8.0% in 2023 - were boosted by Covid and would reverse.

For context, Covid lockdowns led to a boom in e-commerce and demand for specialty packaging just while cardboard and polystyrene producers were having shutdowns. The resulting supply/demand imbalance created an opportunity for Macfarlane to leverage its size and negotiate for better pricing.

While the supply/demand imbalance has reversed and intuitively Macfarlane’s profits should have reversed also, the company has in fact held on to most of its gains.

In its H1 results in August, Macfarlane reported that gross profits were flat and EBIT was only -2%. In it’s brief trading update on November 29, Macfarlane stated that performance for the year should be broadly in line with expectations (for flat profitability y/y) and that “there is good new business momentum”.

The stock has not reacted, but we think the results are good news because it shows that margins have not reversed as some feared with overearning post-Covid and poor U.K. macro. And 9x FCF for a business with strong management and historically high single-digit growth from accretive bolt-on acquisitions is clearly too cheap.

Why have profits not reversed?

We called Macfarlane a middle-man above, but that is an unfair characterization of the company. For customers with high value products, Macfarlane designs all the packaging required, sources corrugate, plastics and other materials from a network of suppliers, and stores those materials on an ongoing basis while providing same-day supply when they are needed. Macfarlane’s solutions are typically under 10% of the value of the item being shipped and mean customers don’t have to spend as much on R&D, logistics, warehousing, operations, etc.

That means Macfarlane is ingrained in the operations of its customers and switching costs are high. The market is disciplined, with the biggest three players (including Macfarlane) controlling half the market.

We think Macfarlane is a higher quality business than investors are pricing in and this year’s results are proving that out.

TerraVest (TVK.TO)

Special Report, Podcast, Presentation

TerraVest is an acquirer and operator of steel-based storage tank and equipment businesses that has delivered shareholder returns of 35% p.a. for the last decade. The company generates a 25% post-tax incremental return on tangible capital and has an excellent and aligned management team who own 35% of the business. We wrote up TerraVest at C$45 in January, and last week it traded at C$120.

While we think management will continue to compound capital at strong returns for many years to come, we note that several of them have been selling shares recently. We also think that sentiment is buoyant and that the company provides limited information when it reports results. For these reasons, a negative result could trigger a large correction.

While the stock is still not expensive at 25x FCF, we have substantially reduced our position. We will continue to cover the company in detail and look for buying opportunities.

We do want to highlight that the CEO of TerraVest, Dustin Haw, is someone worth following across the rest of his career. Haw is only 40 and stays away from the limelight. In our view he is someone of high integrity and has an exceptional track record that is no fluke.

Haw is a rare combination of being both an excellent operator and capital allocator. We did eight reference checks on him before writing our report on TerraVest, and this quote from one source probably sums him up best:

“Unlike most people in finance he understands how to make things. The combination of understanding how the product is made and capital allocation is a deadly force in business and 99% of CEOs don't have both. He has the ability to really understand customers and manufacturing processes…He comes from a small town where you fix things, not bring to someone to fix it.”

Haw is also very aligned with shareholders. He lives off a base salary of C$413k, but owns stock and options worth $60mm today and C$115mm if the stock compounds at 8% until 2032.

At just 40 years old, Dustin Haw has a long runway to compound.

Kyndryl (KD)

Kyndryl is the largest provider of IT services for managing on-premise data centers. The company was spun-off from IBM in late 2021 as a declining and loss making business that was quickly sold down. We published our article when the stock traded at $14, and today it trades at $35. We think our thesis has largely played out and the company is no longer a ‘hidden gem’.

Although Kyndryl appeared to be an unattractive business, several clues suggested it could turn itself around as a standalone company. Management owned and bought a lot of stock, and 40% of the company’s contracts earned 0% gross margin as IBM often bundled these in with other services to fuel growth in other areas.

Our thesis was that the Kyndryl would bring these contracts up to ‘normal’ 20% gross margin levels. That would enable it to generate $3-4/shr in FCF, which at a 10x multiple for a no growth business equated to a stock price of $30-40.

That thesis has largely played out.

The next leg of the thesis requires that Kyndryl become a growth business. If it could achieve $4/shr in FCF and grow at mid-single-digits, it might trade at 15x FCF for a stock price of $60.

That is what management laid out at the company’s Investor Day on November 21. Investors reacted positively to targets for mid-single-digit growth, $4/shr in adj FCF, and a buyback, sending the stock up 15% on the day.

Although these targets are impressive, we are skeptical that sustained growth is achievable. We do note however that the company has voluntarily given up a lot of pass-through revenues over the last 12 months, which sets up a period of easy comps. We can see the company performing well against those comps for a while.

We have spoken with a lot of industry sources over the last few years, and most are skeptical that Kyndryl can achieve sustained growth with consulting and hyperscalers.

Right now, Kyndryl is largely selling consultancy services to existing clients that it deeply understands. It usually does not have to compete with other providers for this business, but if it is to sustainable grow the company will have to start winning new clients.

That is a problem because the company operates at a competitive disadvantage vs players like Accenture and Infosys, who have far superior skills and relationships in the C-suite. Kyndryl talks about the number of AWS and Azure certifications its employee base are gaining, but getting certified is a bit like getting a driver's license - it’s a minimum requirement and does not mean you are a great driver.

Other Updates

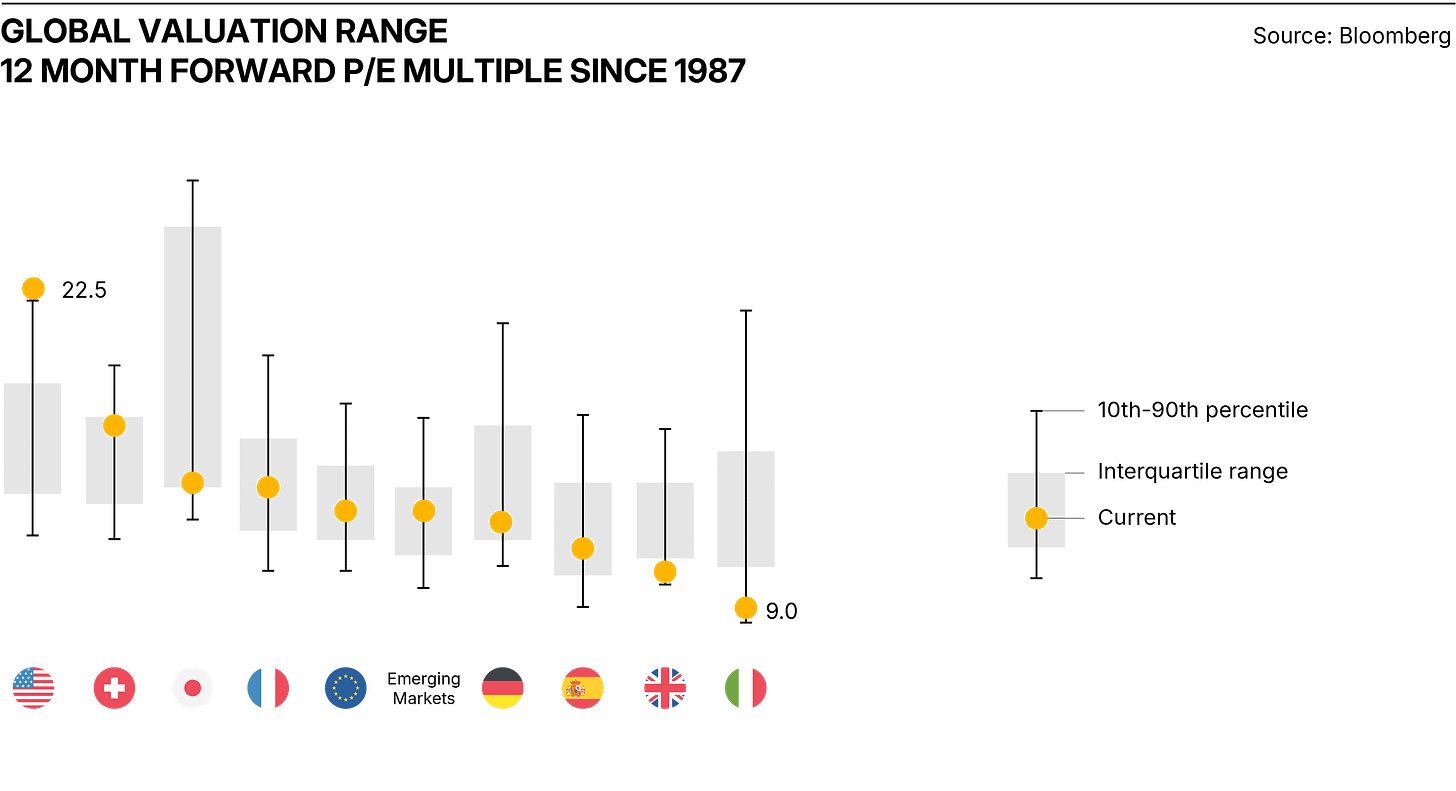

We thought this chart from Neil Woodford’s blog was interesting:

The chart shows that US stocks are trading on 22.5x forward P/E and above the 90th percentile towards expensive, whereas UK stocks trade on 11x P/E and the 10th percentile towards cheap.

We imagine that if adjusted for large vs small cap and ‘growth’ vs ‘value’ stocks, UK and other International small cap value stocks would look incredibly cheap.

This article is for informational purposes only and is not investment advice. Read important disclosures here.