Special Report: Watches of Switzerland (WOSG.L)

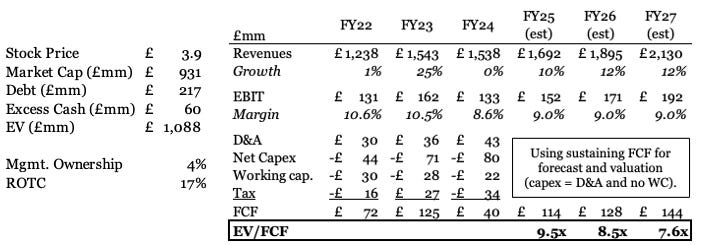

WOSG is a retailer and partner to Rolex trading at 10x FCF with double-digit growth

Situation Overview

Watches of Switzerland is a retailer and partner to Rolex and other luxury watch brands. It trades on 10x FCF despite double digit growth and we think can return 35% p.a. over three years for a 145% total return.

Most of the company’s value lies in its relationship with Rolex, which only sells through authorized retailers like WOSG. That makes WOSG’s economics far superior to a typical retailer and more like a subsidiary of Rolex.

Management are competent, experienced, and well incentivized, with CEO Brian Duffy owning £30mm of stock. Duffy joined in 2014 and his strategy of investing to elevate customer experiences has grown WOSG’s share of Rolex sales in the UK from around 35% to 50%. This encouraged Rolex to entrust WOSG with replicating its strategy in the US, where it is now the number one player with 10% share and has grown at 30% p.a. for the last five years.

The stock has fallen 75% since 2022 after Rolex acquired another retailer and the luxury watch bubble burst. Investors are concerned that WOSG’s relationship with Rolex is in danger, but our work suggests it is not and that the US offers a large structural opportunity for WOSG to deploy capital at 20% returns.

Key Insights

1. WOSG is one of Rolex’s most trusted distributors, sells mostly to customers who register for a waitlist, faces no inventory risk or online competition, and has Rolex prices that only increase. WOSG’s scale gives it significant competitive advantages. (See p. 6-8, 14-17)

2. Rolex is a Swiss non-profit and we believe that the acquisition of its key Swiss retailer happened because the retailer’s founder was about to pass away and Rolex wanted to protect its distribution and maintain Swiss heritage. We do not think Rolex will disintermediate WOSG and believe that WOSG will receive increasing supply. (See p. 18-21)

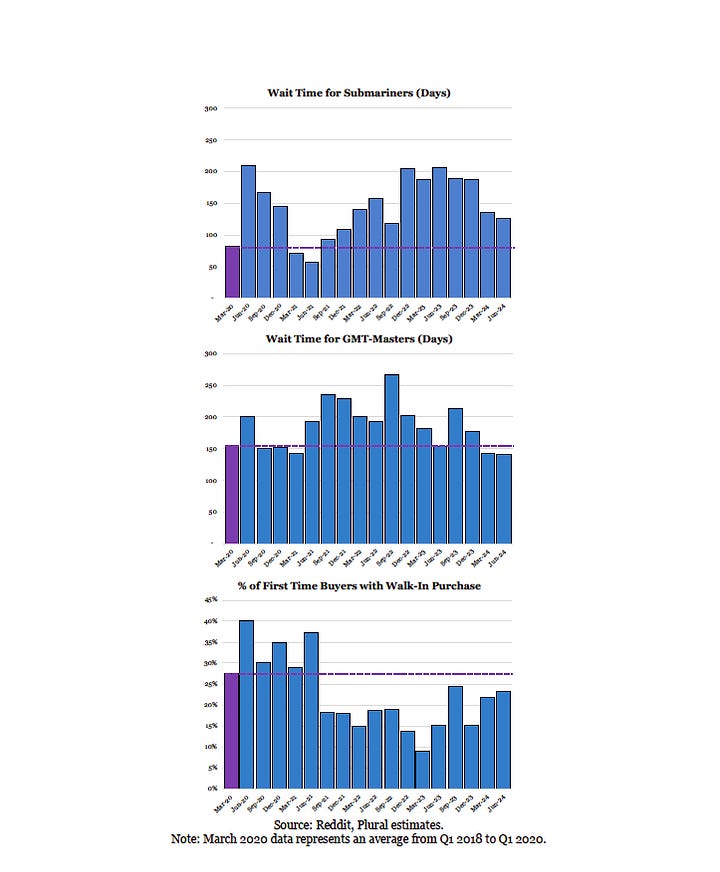

3. Our data shows that Rolex waitlists have returned to normal levels and that historically Rolex has not cut production in these circumstances. In fact, Rolex plans to grow production by 60% by 2029. We think WOSG will be allocated an increasing share of that growth in the US, where purchases of luxury watches per capita are half of UK levels and most retailers are mom & pops who will struggle to compete with WOSG. (See p. 12-13, 22-25)

Research Methods

In addition to utilizing secondary sources such as company filings, transcripts, and services such as Tegus, the information in this report was gathered by speaking with primary sources. This included discussions with:

Watches of Switzerland’s CEO, CFO, and IR

2 former employees at Watches of Switzerland

2 former employees at Rolex

8 former or current employees at competitors to Watches of Switzerland or Rolex

4 other relevant sources

Visits to 3 Watches of Switzerland stores and 7 competitor stores

We spoke with some sources more than once. Information that could reveal the identity of the sources above are redacted from this report unless sources gave their permission, apart from Watches of Switzerland’s CEO, CFO, and IR given the company is publicly traded. While Hidden Gems Investing gained many insights from these conversations, no information that was both material and non-public was shared.

We think you will enjoy this writeup more in a pdf format. Click “Download” below:

Want to receive more reports and insights? Subscribe and upgrade to paid: