Situation Overview

XPEL is a great business going through a blip. The company is the leading supplier of films that protect the paint or windows of your car, a bit like the film protecting your phone’s screen.

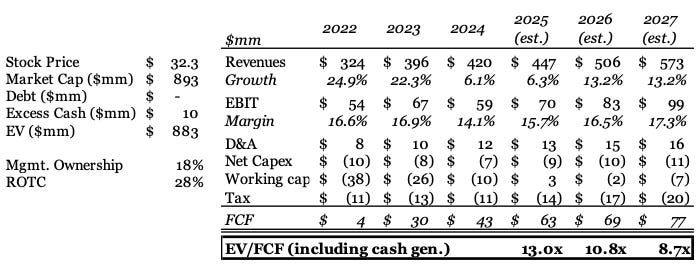

Over the last five years the stock has gone from $15 to $100 and back to $32 after XPEL went from delivering 30%+ returns on capital and 25% growth to suddenly 6% growth and reduced margins in 2024. We believe investors are extrapolating 2024 to be the new normal when in fact XPEL still has a long runway of around 13% organic growth and that margins will rebound.

The company is led by CEO Ryan Pape, who has high integrity, a strong customer focus, and has done an excellent job allocating capital. Pape owns shares worth $35mm and is aged 43, giving him a long runway too and incentive to keep compounding capital.

We think an investment at today’s price carries an asymmetric risk/reward. XPEL reported EPS of $1.65 in 2024 and even assuming no growth or margin normalization over three years and a mere 12x P/E multiple would put the stock on $20. Adding $5 of cumulative cash generation implies a total return of $25 for around 25% downside. On the other hand, we believe that organic growth and reinvesting cash into acquisitions will grow EPS to $3.2 in three years. A 20x P/E, consistent with a business that reinvests all cash at 20% returns, would value the stock at $64 for a double from today's price.

Key Insights

1. XPEL’s moat is underappreciated as the company is more like a franchisor than a supplier. Installers usually exclusively sell XPEL products and the company provides the brand, lead generation, film, software, service, and training. The company has 40% market share in the US and installers who switch to XPEL see a boost in sales. That is the key attraction for installers and is very hard for competitors to replicate. (see p.10-13)

2. XPEL has a long runway to grow around 13% because of large reinvestment opportunities across the car dealership and OEM channels, Asia and Europe, and by using it’s significant pricing power. The company has already been successful in all these areas and largely just has to keep executing. (see p.14-23)

3. The sudden deceleration in growth in 2024 and probably 2025 is largely explained by tough cyclical conditions. XPEL’s traditional markets are maturing, but successful new growth drivers are already partially offsetting that and will increasingly do so. (see p.24-27)

Research Methods

In addition to utilizing secondary sources such as company filings and transcripts, the information in this report was gathered by speaking with primary sources. This included 54 long-form discussions with:

XPEL’s CEO and CFO

4 former senior XPEL employees

6 competitors to XPEL

8 installers or dealers

2 suppliers to XPEL

2 OEMs

7 other relevant sources

Additionally, dozens of short discussions with XPEL and competitor installers and dealers across North America, Europe, and Asia.

We spoke with some sources several times. Information that could reveal the identity of the sources above are redacted from this report unless sources gave their permission, apart from XPEL’s CEO and CFO were appropriate as the company is publicly traded. While Hidden Gems Investing gained many insights from these conversations, no information that was both material and non-public was shared.

We think you will enjoy this 35 page writeup more in a pdf format. Click “Download” below: